Indicators on Paul B Insurance You Should Know

Some Of Paul B Insurance

Table of ContentsWhat Does Paul B Insurance Mean?Fascination About Paul B InsuranceRumored Buzz on Paul B InsurancePaul B Insurance - QuestionsThings about Paul B InsuranceThe Buzz on Paul B Insurance

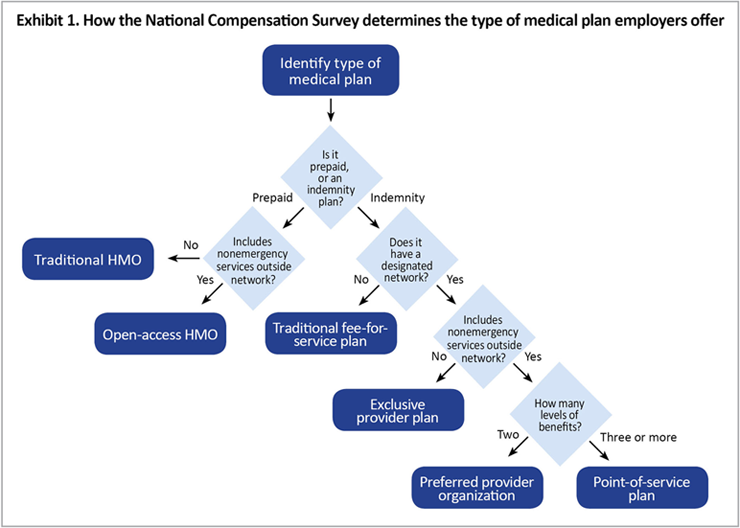

Relevant Subjects One reason insurance problems can be so confounding is that the medical care market is continuously transforming and the insurance coverage prepares offered by insurers are difficult to classify. In other words, the lines in between HMOs, PPOs, POSs as well as other kinds of protection are typically blurred. Still, recognizing the make-up of various plan kinds will certainly be practical in assessing your choices.

When the insurance deductible amount is gotten to, additional health and wellness expenses are covered in conformity with the provisions of the medical insurance plan. A worker could after that be liable for 10% of the expenses for treatment received from a PPO network carrier. Down payments made to an HSA are tax-free to the company as well as worker, and also cash not invested at the end of the year might be surrendered to spend for future medical costs.

How Paul B Insurance can Save You Time, Stress, and Money.

(Company contributions need to be the exact same for all workers.) Workers would be in charge of the very first $5,000 in medical costs, yet they would certainly each have $3,000 in their individual HSA to pay for medical expenditures (as well as would have a lot more if they, also, added to the HSA). If workers or their family members exhaust their $3,000 HSA quantity, they would pay the next $2,000 expense, whereupon the insurance policy would start to pay.

There is no limitation on the amount of money a company can add to employee accounts, nonetheless, the accounts may not be funded via worker salary deferrals under a cafeteria strategy. Additionally, employers are not allowed to refund any type of component of the balance to staff members.

Do you know when one of the most terrific time of the year is? No, it's not Christmas. We're discussing open enrollment season, baby! That's appropriate! The enchanting season when you reach important link compare wellness insurance policy prepares to see which one is best for you! Okay, you got us.

Some Known Facts About Paul B Insurance.

But when it's time to pick, it is very important to recognize what each strategy covers, just how much it costs, and where you can utilize it, right? This stuff can really feel challenging, however it's less complicated than it appears. We assembled some useful discovering steps to help you feel great concerning your alternatives.

Emergency treatment is commonly the exception to the guideline. Pro: Most PPOs have a decent selection of service providers to choose from in your location.

Con: Greater costs visit the site make PPOs a lot more costly than other sorts of plans like HMOs. A wellness maintenance company is a health insurance plan that generally only covers treatment from medical professionals that benefit (or agreement with) that specific plan.3 Unless there's an emergency, your plan will certainly not pay for out-of-network care.

The Single Strategy To Use For Paul B Insurance

More like Michael Phelps. It's great to understand that plans in every classification give some kinds of free preventive treatment, and also some deal cost-free or discounted medical care services prior to you meet your deductible.

Bronze strategies have the cheapest monthly costs yet the highest out-of-pocket costs. As you work your method up through the Silver, Gold as well as Platinum classifications, you pay a lot more in costs, yet less he said in deductibles and coinsurance. As we mentioned before, the extra expenses in the Silver classification can be reduced if you qualify for the cost-sharing reductions.

The Single Strategy To Use For Paul B Insurance

When selecting your wellness insurance plan, don't forget healthcare cost-sharing programs. These work basically like the various other wellness insurance coverage programs we defined already, however practically they're not a form of insurance policy. Permit us to describe. Health cost-sharing programs still have month-to-month costs you pay as well as defined coverage terms.

If you're trying the do it yourself course as well as have any type of lingering questions about wellness insurance policy strategies, the specialists are the ones to ask. And also they'll do greater than just answer your questionsthey'll also locate you the very best rate! Or perhaps you 'd such as a method to integrate obtaining great healthcare insurance coverage with the opportunity to assist others in a time of requirement.

Fascination About Paul B Insurance

CHM assists family members share healthcare expenses like clinical examinations, pregnancy, hospitalization as well as surgery. And also, they're a Ramsey, Trusted companion, so you know they'll cover the clinical bills they're expected to and also recognize your coverage.

Key Question 2 One of the important things healthcare reform has carried out in the united state (under the Affordable Treatment Act) is to introduce more standardization to insurance coverage plan advantages. Prior to such standardization, the benefits provided different significantly from plan to plan. Some strategies covered prescriptions, others did not.